Good Afternoon,

I am working on an NIH R25 conference grant which will have

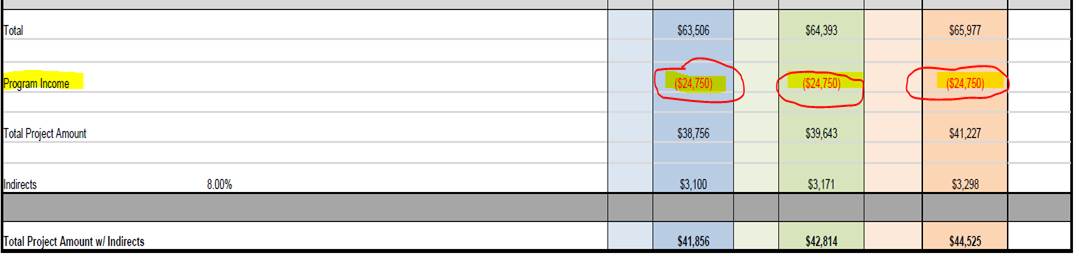

program income each year of $24,750. I am trying to understand how to handle this on the Pre-Award/Proposal submission side.

Does this income need to be deducted from the actual grant $ request?

Currently, the budget prepared by the division has the program income deducted from direct costs and from receiving F&A as well but our federally negotiated rate agreement doesn’t list this as an exclusion

in calculating our F&A base (MTDC).

We rarely encounter earned program income on a grant so I am not certain how to proceed. I understand there are very specific guidelines on how to track/report cost shared on a

funded project.

Any thoughts are appreciated!

Candice

Candice (Foster) Klinge

Manager, Grants Administration – Pre-Award

Research Business Operations

Children's Research Institute - The Children's Mercy Hospital

2401 Gillham Road

Kansas City, MO 64108-4619

Phone: 816-701-1343 (CMH ext. x41343)

Email:

xxxxxx@cmh.edu

![]()